Stated Income Home Equity Line Of Credit

Borrowers need to have good credit scores plenty of cash reserves and a large down payment. Additionally this Stated Income Line of Credit is most popular in Los Angeles and Northern California.

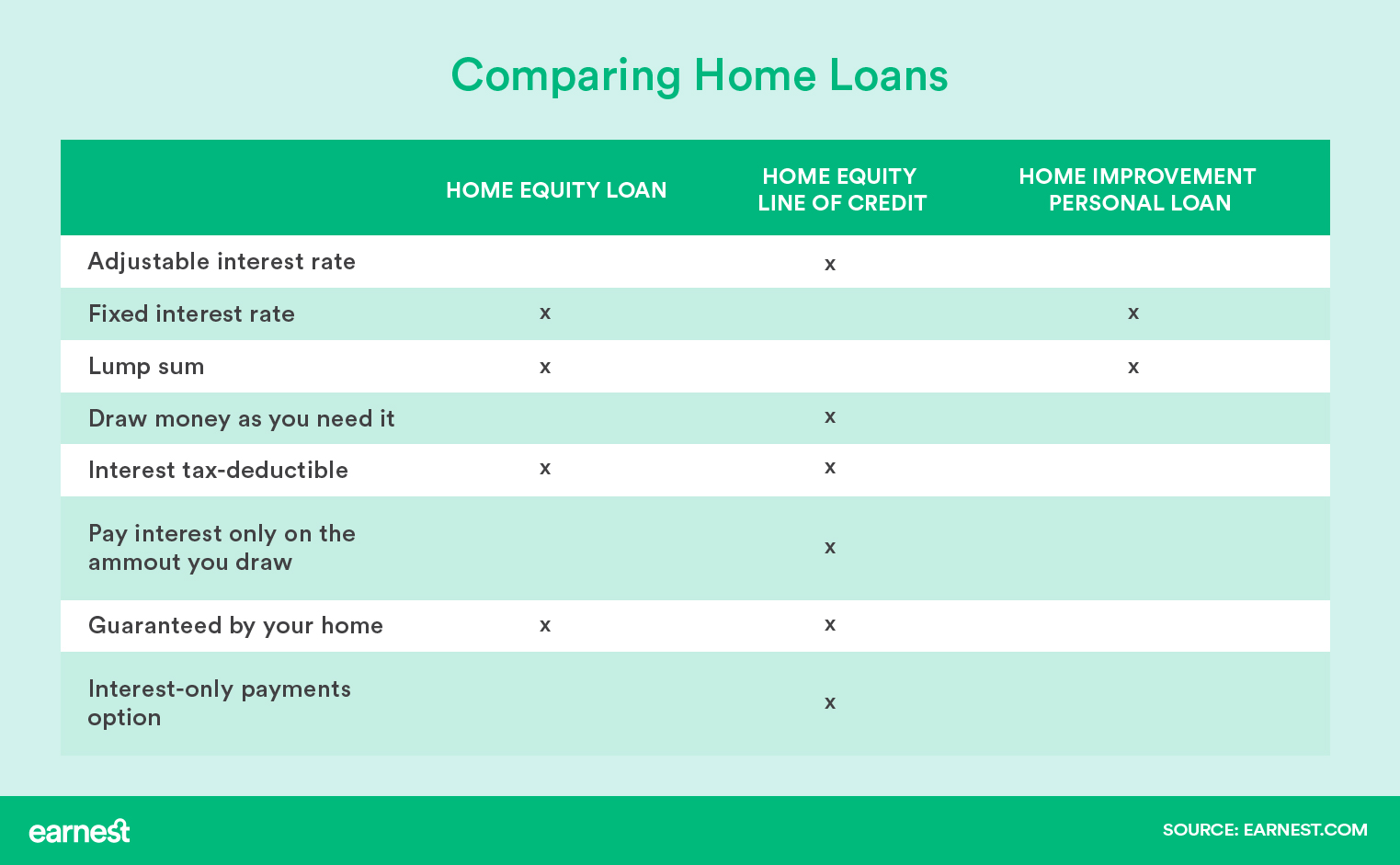

Helpful Financial Tips On Home Equity Loans Great Financial Advice Home Improvement Loans Home Renovation Loan Home Equity Loan

Helpful Financial Tips On Home Equity Loans Great Financial Advice Home Improvement Loans Home Renovation Loan Home Equity Loan

Try our free demo account.

Stated income home equity line of credit. Ad One of the top CFD Platforms. Ad Find Home Equity Line Of Credit Terms and Related Articles. Ad Understand mortgage jargon know which home loan rate you should take in todays market.

Interest-only payments during 10 year draw period then amortizes over 15 years from end of draw period. Some of these lenders are now qualifying the buyer by an analysis of their bank statements rather than tax returns. Our Equity Line of Credit for 2019 We dont make you Jump Through Hoops Hot Loan Product 5 is an Easy Stated Income Stated Assets loan program for 2019.

Stated Income Home Equity Line of Credit HELOC Owner-Occupied Non-Owner Occupied and Second Homes - SFRs 2-4s and Condos. With a typical home-equity line of credit you will have to be able to verify that you make a certain amount of money in order to qualify. Ad One of the top CFD Platforms.

These new stated income mortgage loans are often referred to as bank statement loans alt doc loans or alternative income verification loans. No Income Verification Home Equity Loan HELOC and Refinance Credit Line Highlights. No income home equity loans and equity lines of credit are an easy way for self-employed borrowers to get access to cash without having to dip into personal savings or paying super high interest rates from unsecured loans.

You will simply tell the lender how much money you make and they will take you at your word without any income verification processes. Your rate will be based on your credit history and may vary based on creditworthiness qualifications and collateral conditions. Many stated income loans are based on the equity position of the property which means that the more the borrower puts down the easier itll be to get the loan.

The Federal Reserve may be hiking rates but many lenders are easing credit standards and reducing income requirements for consumers seeking reduce documentation and stated income home equity loan programs. After introductory period ends rates start at 899. Home Lines of Credit for Investors - Stated Income Loans 79 to 105 Line of Credit 1500000 to 12500000 In the first place Equity Development offers unique secured revolving lines of credit to professional investors who purchase renovate and sell distressed properties.

0 interest for first 6 12 months. 620 FICO neededUp to 5. If your credit score is between 400 699 FICO a co-signer will be required and must have a 700 FICO.

Ad Find Home Equity Line Of Credit Terms and Related Articles. A stated income HELOC home equity line of credit uses the equity in your home as collateral for a revolving credit line. The maximum rate for a home equity line of credit HELOC is 325 APR.

Get up to 2000 cash when you refinance with us today. Whether you are looking for a stated income loan in California New York or any of the other 48 states we can help. Get up to 2000 cash when you refinance with us today.

Typically there is more equity required on no doc loans. Rates are accurate as of 412021. With a stated-income HELOC this is not the case.

Try our free demo account. Low-docno-doc loan programs are used for purchase loans fixed rate home equity loans and home equity credit lines HELOCs but no stated income for mortgages above 100. 600 Credit Scores Hybrid Refinance ARMs.

This SISA loan is up to 65 LTV or CLTV. Ad Understand mortgage jargon know which home loan rate you should take in todays market. Technically you are not just merely stating your income but rather using an alternative means to verify your income both personal and business bank statements may be used.

If you have a 700 FICO no co-signer is required. This loan can be in 1st or 2nd position. Working with a mortgage broker can help a borrower leverage all his or her income streams in seeking home equity financing or a secured line of credit.

Lenders who offer stated income mortgages arent qualifying borrowers nonchalantly. The simplest method for accessing a stated income home equity loan is to work with a qualified mortgage broker who will be able to access varied lenders and pools of capital that may not otherwise be available to the individual consumer.

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Stated Income Construction Loan Programs Are Now Available Get Free Expert Advice At Construction Loan C Construction Loans Construction New Home Construction

Stated Income Construction Loan Programs Are Now Available Get Free Expert Advice At Construction Loan C Construction Loans Construction New Home Construction

Home Equity Line Of Credit The Simple Guide To Heloc Home Equity Line Home Equity Line Of Credit

Home Equity Line Of Credit The Simple Guide To Heloc Home Equity Line Home Equity Line Of Credit

This Refi Program Is Saving Homeowners 1 000 S Take This 2 Min Survey To See If You Qualify Homeowner Home Buying House Styles

This Refi Program Is Saving Homeowners 1 000 S Take This 2 Min Survey To See If You Qualify Homeowner Home Buying House Styles

No Document Loans For 2021 No Doc Loans No Tax Returns Refinance Loans Mortgage Loans Debt To Income Ratio

No Document Loans For 2021 No Doc Loans No Tax Returns Refinance Loans Mortgage Loans Debt To Income Ratio

What Is A Home Equity Loan Or Line Of Credit Mid Hudson Valley Federal Credit Union

What Is A Home Equity Loan Or Line Of Credit Mid Hudson Valley Federal Credit Union

Lenders Will Always Verify A Borrower S Income Before Approving A Loan However For The 9 Million Peo Home Improvement Loans Remodeling Loans Home Equity Line

Lenders Will Always Verify A Borrower S Income Before Approving A Loan However For The 9 Million Peo Home Improvement Loans Remodeling Loans Home Equity Line

The 5 Best Home Equity Loans Of 2021 Money

The 5 Best Home Equity Loans Of 2021 Money

Guide And Tips Home Equity Homeequitylineofcreditguide Home Equity Home Equity Loan Home Equity Line

Guide And Tips Home Equity Homeequitylineofcreditguide Home Equity Home Equity Loan Home Equity Line

Jumbo Loan Mortgage Info Jumbo Loans Jumbo Mortgage Loan

Jumbo Loan Mortgage Info Jumbo Loans Jumbo Mortgage Loan

Best Rates For Home Equity Line Of Credit Loan Home Equity Line Home Equity No Credit Loans

Best Rates For Home Equity Line Of Credit Loan Home Equity Line Home Equity No Credit Loans

Coulee Bank Home Equity Line Of Credit Billboard Home Equity Line Home Equity Commercial Loans

Coulee Bank Home Equity Line Of Credit Billboard Home Equity Line Home Equity Commercial Loans

If You Have Bad Credit And Need A Mortgage You Can Qualify For A Bad Credit Fha Loan With A Credit Score As Low As 50 Fha Loans Bad Credit Mortgage

If You Have Bad Credit And Need A Mortgage You Can Qualify For A Bad Credit Fha Loan With A Credit Score As Low As 50 Fha Loans Bad Credit Mortgage

The Fix Flip Business Line Of Credit Is A Stated Income Credit Line For Real Estate Investors To Finance R Loans For Bad Credit Business Loans Line Of Credit

The Fix Flip Business Line Of Credit Is A Stated Income Credit Line For Real Estate Investors To Finance R Loans For Bad Credit Business Loans Line Of Credit

Stated Income Mortgage Lenders Online Mortgage Mortgage Loans Buying A New Home

Stated Income Mortgage Lenders Online Mortgage Mortgage Loans Buying A New Home

Revolving Debt A Line Of Credit With No Repayment Schedule

Revolving Debt A Line Of Credit With No Repayment Schedule

What Percentage Can You Borrow On A Home Equity Loan The Borrowers Home Equity Loan Home Equity

What Percentage Can You Borrow On A Home Equity Loan The Borrowers Home Equity Loan Home Equity

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Comments

Post a Comment